American Senior Benefits of North Texas

Retirement Income Planning

Retirement Income Planning

American Senior Benefits of North Texas is passionate about helping our clients prepare for a comfortable and secure retirement. With a custom-tailored plan, we can show you where your retirement income will come from by finding out your specific retirement goals and how long you have to meet them.

Creating A Strategy For Your Future

Our main goal is for you to never run out of money because you cannot afford for it to run out. You and your family's future are too important. Our affiliated agents can help you create a strategy that is manageable, realistic, and beneficial in the long run with guaranteed income, growth potential, and flexibility.

401(K), 403(B), IRA - Rollover

You can roll over your IRA, 401(k), 403(b), or lump sum pension payment into an annuity tax-free. Annuities funded with an IRA or 401(k) rollover are "qualified" plans, enabling an insurance company to create an "IRA annuity," into which you can deposit your retirement funds directly.

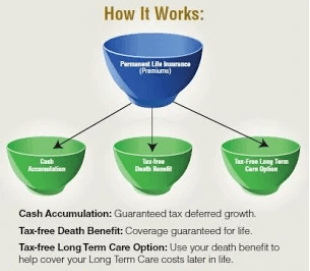

Life Insurance With Long Term Care Benefits

Simply put, a hybrid long-term care policy combines the benefits of life insurance (or annuity) with long-term care benefits. A person can buy a hybrid policy by paying a one-time lump sum premium or by paying over a number of years. If it turns out long-term care is not needed, the policy works much like a traditional life insurance policy, with a death benefit paid to a beneficiary when the insured person passes away. If the insured person does need long-term care, the policy will pay benefits toward those expenses. Similar to a traditional long-term care policy, the benefits are paid in an amount chosen when the policy is purchased and expressed as an amount per day, month, or year.

Long Term Care Insurance

Long-term care insurance is an insurance product, sold in the United States, United Kingdom, and Canada, that helps pay for the costs associated with long-term care.Long-term care insurance covers care generally not covered by health insurance, Medicare, or Medicaid.

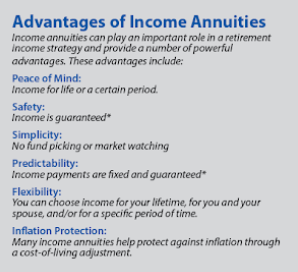

Guaranteed Lifetime Income

A lifetime annuity is a financial product you can buy with a lump sum of money. In return, you will receive income for the rest of your life. A lifetime annuity guarantees payment of a predetermined amount for the rest of your life. This is different from a term annuity, which only pays you for a fixed amount of time.

Plan For A Successful Retirement

It is never too late to begin planning for a successful retirement because life will inevitably throw you curveballs you may be unprepared for, such as unplanned medical bills. We can help you get the most from your assets now and in the years ahead with retirement readiness.